After the annual swings of profits and losses during the first five years of EL AL’s complete privatization, EL AL appointed Elyezer Shkedy as President and CEO effective the first day of 2010. He previously had a distinguished career in the Israeli Air Force, ultimately serving as Commander in Chief.

Shkedy faced the difficult task of dealing with continuing major issues confronting EL AL. These included greater competition arising from Israel’s adoption of a new liberal aviation policy (known as ‘Open Skies’) even though Israeli airlines continued to face greater restrictions than foreign air carriers due to Israel’s geopolitical situation; relatively high operating costs arising from collective labor union agreements and security requirements; and the need for further fleet renewal. These themes would dominate the 2010s decade.

Competition

By 2010 EL AL was competing on flights to and from Israel with about 120 airlines, including Israeli airlines Arkia and Israir; 59 foreign airlines operating scheduled flights to 72 destinations in 36 countries; and 60 airlines operating charter flights (of which 32 operated year-round).

Existing foreign airlines were continually expanding their seat capacity to Israel, both by increasing the number of their flights to Israel as well as the size of their aircraft on the route, and more new airlines were entering the Israeli market. Many of these airlines operated international hubs at their home country airports, and they used this increased seat capacity to fly passengers between Israel and a huge number of destinations via indirect flights, taking advantage of their route networks and those of their partners in global airline alliances and code sharing arrangements.

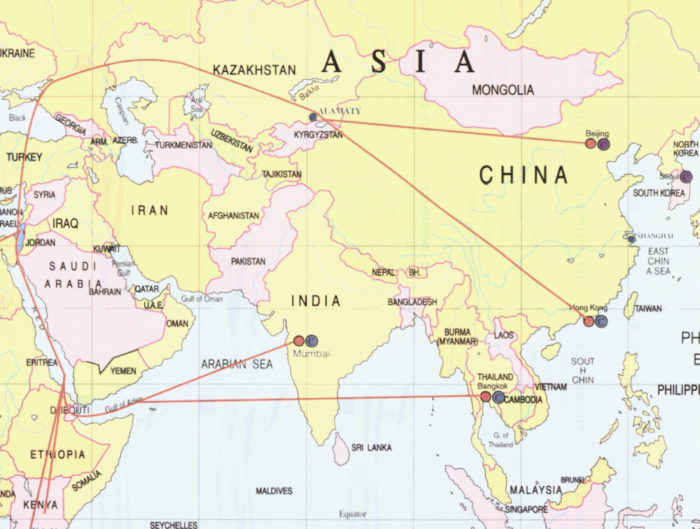

Meanwhile, due to Israel’s geopolitical situation, EL AL could not fly to or over several countries hostile to Israel, including Lebanon, Syria, Iraq, Iran, Saudi Arabia and the Gulf States. This meant that EL AL had to take costly and time-consuming circuitous routes to reach destinations in India and the Far East.

— The ‘Open Skies’ Open Wider

Against this backdrop of competition, the Israeli government continued its path of liberalizing Israel’s aviation policy so as to encourage more airlines to fly to Israel and thereby bring in more tourism.

Talks continued during 2010 – 2013 between Israel and the European Union on formulating a ‘global’ EU aviation agreement that would apply to all flights between Israel and any EU member country. Finally, and most significantly, on 10 June 2013 Israel and the European Union signed a comprehensive ‘Open Skies’ Agreement that entered into effect at the beginning of 2014.

The Israel-EU ‘Open Skies’ Agreement greatly expanded the rights of airlines to fly between Israel and EU countries. It permitted all airlines in the EU to operate direct flights to Israel from any location in the EU, and Israeli airlines to operate direct flights to airports throughout the EU. The Agreement replaced all of the bilateral agreements between Israel and the individual EU countries, and gradually, over the five-year period of 2014 to 2018, it canceled restrictions on the number of airlines, frequencies, capacities and types of aircraft allowed to carry passengers between Israel and the EU.

The impact of the Agreement was immediate. More new airlines started operating the route to Tel Aviv. Existing airlines launched flights to Tel Aviv from more locations in the EU, even from airports outside their home country, and expanded frequencies on their existing routes to Israel. ‘Low-cost’ airlines in particular took advantage of the new liberalized aviation policy by opening new routes and increasing frequencies and capacity. Led mainly by easyJet (England), Wizz Air (Hungary), Air Berlin, Pegasus (Turkey), Jetairfly (Belgium), Norwegian Air Shuttle, and Transavia (owned by Air France-KLM), in 2014 low-cost airlines increased their passenger numbers to and from Israel by 39% and accounted for 12% of all passenger traffic at Ben-Gurion Airport.

Nor was liberalization of aviation policy confined to Israel’s relationship with EU countries. On 1 December 2010 Israel signed a new bilateral aviation agreement with the U.S., which became effective 29 March 2011. It allowed more airlines to operate between Israel and the U.S. and increased the number of flights permitted to existing airlines operating between the two countries. During 2010-2014 the Israeli government entered into new, more liberal, aviation agreements with several more countries, including China, Russia and Ethiopia, and in January 2015 Israel signed a new aviation agreement with Canada – in each case increasing the allowable number of airlines, frequencies and capacity on routes to and from Tel Aviv.

— EL AL’s Response

EL AL’s objections to the sharp liberalization of Israel’s aviation policy, citing the airline’s competitive handicap due to Israel’s geopolitical situation and much higher security costs, did not stop the Israeli government’s path. Nor was the State’s policy slowed when the worker unions of all three Israeli airlines with international routes (EL AL, Arkia and Israir) went on strike in connection with the Israeli Cabinet’s approval of the Open Skies agreement with the EU in April 2013. However, to partially level the unbalanced competitive environment, the government finally agreed to increase the portion it pays of the Israeli airlines’ security costs to 97.5%.

On the positive side, as detailed below, EL AL accelerated its efforts to cope with the competition. It invested in fleet modernization, including the purchase of eight new 737-900 Extended Range aircraft for its short and medium-haul routes. It introduced a new fare scheme and brand called ‘UP’ to compete with ‘low-cost’ airlines on selected routes, and entered into additional ‘code share’ arrangements with foreign airlines to increase destinations and connectivity. EL AL also invested in technology to better adapt its schedule to seasonality of traffic and international developments, and added flight frequencies to popular destinations. It also took steps to enhance service to passengers, including seat comfort, food quality and variety, flight entertainment, and frequent flyer benefits.

Fleet Renewal

— Short and Medium-Haul Renewal: 737-900ERs

To replace EL AL’s aging narrow body Boeing 757-200s, serving short and medium-haul European and Mediterranean destinations, and to keep its fleet younger and reduce aircraft types, EL AL selected Boeing’s 737-900ER (Extended Range) model. In February 2011 it ordered from Boeing six new -900ERs plus options for two more (exercised in 2013) for a total purchase price of $430 million. The -900 model is essentially a stretched version of the 737-800s already in EL AL’s fleet, being almost nine feet (3m) longer, accommodating more passengers at a lower seat-mile cost.

EL AL received its first 737-900ER, 4X-EHA, from Boeing on 8 October 2013. The remaining seven (registrations 4X-EHB through EHF and EHH/EHI) were received between November 2013 and March 2016. All were delivered with winglets that reduce fuel consumption. Each -900 aircraft, like the -800 model, is powered by two CFM International 56 engines (CFMI is an equal joint venture between Safran Aircraft Engines of France and General Electric of the U.S.).

EL AL configured its 737-900ERs with 172 seats – 16 in Business and 156 in Economy. Each features the innovative Boeing Sky Interior, with variable in-flight LED mood lighting, and large storage bins for carry-on luggage, power sockets for laptops and USB connections at all seats, as well as a new interior design and modern ergonomic seats.

Meanwhile, EL AL retired its last five 757s (4X-EBM/S/T/U/V) in 2011 and 2012, the last two (EBU and EBV) being withdrawn from use in November 2012 – 25 years after EL AL started operating its first 757 aircraft.

To further meet its need for additional short and medium-haul aircraft during the decade of the 2010s, EL AL during 2010 – 2014 leased four more 737-800s, previously operated by other airlines. These were registered 4X-EKM/R/T/U. Also, in 2011 EL AL started adding winglets, for fuel savings, to its entire 737-800 fleet, which rose to 15 aircraft in 2014.

— Long-Haul Fleet Renewal

For long-haul routes to North America and the Far East, operated by larger wide-body aircraft, EL AL faced a more serious problem. At the start of 2010, the average age of three of its four wide-body types was significantly high. Its four remaining 767-200s averaged 23 years in age; five 747-400s averaged 14.5 years; and three leased 767-300s averaged 17 years. Only its 777-200s were relatively young with an average age of 6.6 years.

In 2008 EL AL had ordered from Boeing four more new 777s. However, due to the global economic crisis of 2008-2009, EL AL canceled this order, while agreeing with Boeing to apply its advance payment to future purchases. In June 2012 EL AL took a $40 million loan from Boeing to finance the purchase of one of Boeing’s latest 787 ‘Dreamliner’ aircraft and the lease of two others, for delivery in 2015-2016. However, the deal was dropped, and a decision on possibly purchasing the 787 ‘Dreamliner’ was postponed.

The 767-200s in particular were reaching the end of their economically useful life, especially due to the need for increased maintenance. So EL AL retired two of the last four (4X-EAC/EAD) in October 2011, and the final two (4X-EAE/EAF) in May and October 2013 respectively, completing a 30-year period in which the 767-200 type operated in EL AL’s fleet.

As an interim step, pending a delayed future decision on acquiring new wide-body aircraft, EL AL leased four additional 767-300 Extended Range aircraft, previously operated by other airlines, one each in 2010 (4X-EAK), 2011 (-EAL), 2012 (-EAM) and 2015 (-EAN). The 767s were mainly utilized on routes to Bangkok, Beijing, Mumbai, Johannesburg, London and Toronto.

EL AL management continued to discuss during 2012 – 2014 the timing and choice of new aircraft for the modernization of its wide-body long-haul fleet. Negotiations ensued with Boeing on its offerings, the 787 ‘Dreamliner’ and 777-300, and with Airbus on its A350s and A330s. A final decision – selecting Boeing’s acclaimed 787 Dreamliner aircraft – ultimately came in 2015 (see Chapter 12, in preparation).

EL AL ended 2014 with 40 aircraft in its fleet – six 777-200ERs; six 747-400 passenger aircraft and one leased 747-400F cargo plane; six 767-300ERs (four of which were leased); two 737-700s; fifteen 737-800s (nine of which were leased); and four 737-900ERs.

— Long-Haul Aircraft Interiors

During 2012 – 2014 EL AL renovated the interiors of its 747-400 and 767-300 fleet, including new Business Class seats and a refreshed appearance. It also launched a new class of service, ‘Economy Class Plus’, situated in front of the regular Economy class in its aircraft. The new class, typically about 36 to 40 seats, featured improved seats with more leg room and lean-back space, special check-in counters, and other amenities. First introduced on its 747-400s starting July 2012, the new class was then added to the 777s in 2013 and 767-300s in 2014.

EL AL’s ‘UP’ Airline Brand

To counter the major increase of ‘low-cost’ airlines flying to Israel, which were drawing away some of its passenger market, EL AL considered establishing a separate airline subsidiary with its own aircraft and crews to operate lower cost flights, as some foreign airlines had done. However, it chose not to do so.

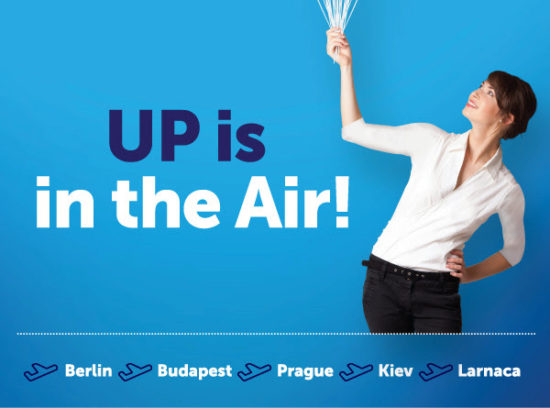

Instead, in 2013 EL AL established a new aviation brand called ‘UP’. UP was not a separate airline; its aircraft and crew were those of EL AL. To give the appearance of a separate operation, four of EL AL’s 737-800 single aisle aircraft (4X-EKM/O/T/U) were repainted in a new ‘UP’ color scheme. A new ‘UP’ website was launched, and marketing materials, ticketing and crew insignia all featured the ‘UP’ logo and style.

The aircraft had two service classes: Economy (144 seats) and Economy Plus (36 seats). The fare policy was similar to that of ‘low-cost’ airlines and offered two types of tickets: (1) the UP Basic Ticket – the lowest fare, on which the passenger was assured a seat but paid extra for any additional desired services, such as luggage, seat selection, and food; with fees for flight changes and no refund for cancellation; and (2) the UP Smart Ticket which included the foregoing additional services, Economy Plus seating, access to EL AL’s King David lounge at Ben-Gurion Airport, free check-in at the airport, and flexible ticket terms. Five destinations were selected for UP flights (which replaced regular EL AL flights) – Berlin, Budapest, Kiev, Prague and Larnaca. UP flights started on 30 March 2014.

The UP flights were popular with tourist class travelers, but eventually many business passengers asked EL AL to reinstate Business Class service on flights to the five selected UP destinations. Also, employing the separate brand proved unwieldy. At the same time several major airlines adopted a different approach to counter the ‘low-cost’ airlines that relied on a basic fare with an extra charge for virtually every service other than a place to sit on the plane. That new approach was to add a ‘basic fare’ choice to the Economy class on their regular scheduled flights, with other services such as checked luggage, seat selection, more flexible ticket change terms, etc. at an extra charge. In 2018 EL AL decided to take that newer, more efficient, approach, and the UP brand was discontinued. The four ‘UP’ aircraft were repainted back into standard EL AL colors.

Code Share Arrangements and Connectivity

Code sharing allows one airline to market flights operated by another air carrier as if they were its own flights. It gives the participating carriers the opportunity to increase flight frequencies to existing destinations and to access new destinations, including by means of flight connections. There are also marketing advantages, including amplifying the attractiveness of joining the participant’s frequent flyer program.

During the first half of the 2010s EL AL participated in code sharing arrangements with several airlines including, for example, Air China, American Airlines, Iberia, Swiss, Thai Airways and WestJet of Canada.

In November 2014 EL AL entered into a code share agreement with U.S.-based jetBlue Airways. The agreement allows EL AL passengers to purchase combined flight tickets under the EL AL flight code, with connection flights via New York JFK and Newark airports (and later Boston) to, initially, 38 jetBlue destinations across the U.S.

Meanwhile, EL AL’s code share agreement with American Airlines was modified following the merger of American with US Airways in December 2013. Thereafter, their code share arrangement only applied to flights via destinations in Europe served by both airlines. EL AL could thereby sell code-share tickets for flights operated by American Airlines between Europe and the U.S., and American could sell code-share tickets for flights operated by EL AL on routes between Europe and Israel.

Route Developments

For some years EL AL had flown from certain European destinations directly to Eilat, Israel’s resort at its southern tip bordering the Red Sea. On 1 August 2010 EL AL started flying to Eilat domestically from its home base at Tel Aviv’s Ben-Gurion Airport, in competition with the two main other Israeli airlines serving Eilat — Arkia and Israir.

Although the Tel Aviv-Eilat route proved satisfactory for EL AL, due to safety concerns about the small airport at Eilat and changes mandated by Israel’s Civil Aviation Authority to the related landing and takeoff aerial procedures there, EL AL discontinued the route on 18 November 2013

In the interest of reducing uneconomic routes during the first half of the 2010s, EL AL discontinued its routes to Sao Paulo, Brazil, and Odessa and Dnepropetrovsk, Ukraine, in November 2011 and to Cairo in May 2012. Although the Sao Paulo route enjoyed high passenger occupancy, the high fuel prices at the time made the route too costly to operate.

On the other hand, due to increased demand, new scheduled service started in November 2013 to Larnaca, Cyprus and Venice, Italy.

Technology Advances

In keeping with continuing rapid advances in computers and electronics, EL AL introduced during 2010 – 2014 several new or enhanced technologies.

— Environmental.To reduce fuel usage and emissions in flight, a new computerized flight planning system entered service at EL AL’s control center in June 2010. The system plans optimal flight routes, taking into account costs, flight distances and fuel required, interfacing with the airline’s other systems. Also, in January 2011 EL AL started operating a CO2 emission monitoring and tracking system, in compliance with EU guidelines. It collects data from ground and aircraft sources and concentrates it into a single database, with tools for data analysis.

— ‘Electronic Flight Bag’ for Pilots. In 2013 EL AL introduced an ‘Electronic Flight Bag’ program, following a trend that began with other major airlines. Starting with 777 captains and later continuing onto other flight deck crew, EL AL pilots are outfitted with iPads for use in the cockpit throughout all stages of the flight. These replace the various flight maps, aircraft literature and other documents, weighing about 88 pounds (40 kilos) previously in the cockpit. The iPads also include a designated app that enables better access to weather data and flight conditions.

— Mobile App. In July 2013 EL AL introduced its mobile app allowing passengers to manage their flight straight from their smartphone, including booking a flight, managing reservations, express check-in, and arrival and departure information.

— New Flight Entertainment System. In June 2014 EL AL launched on some of its routes and aircraft a flight entertainment system containing an inter-aircraft communications ‘streaming’ system, accessed by a free app, ‘DreamStream by EL AL’. The service allowed passengers to enjoy their choice of a variety of movies, TV shows, songs, games, children’s content, religious content, information to passengers, etc.

— Enhanced Computer Systems. To improve efficiency, EL AL introduced a new innovative revenue management system, including a computerized pricing and fare management system that automatically updates fares in all its distribution systems reflecting the airline’s strategies and constant changes in market demand. Also, in September 2014 EL AL introduced a new system for planning cargo loading, based on cloud architecture that calculates aircraft weight, balance and load factors and produces an electronic weight and balance form, obviating the need for manual data transfer and improving data reliability.

— Cybersecurity. The airline upgraded its focus on enhancing its procedures to neutralize any attempts to breach its computer security.

— Enhanced Website. In March 2011 EL AL launched a new enhanced website; and due to rapid advances in technology its website was improved again in the second quarter of 2014. Online website sales continued to grow rapidly, with a 19% increase in 2013 and 24% more in 2014.

Security

— State Share of High Security Costs. On 3 August 2011 EL AL signed an understanding with the State of Israel that provided a gradual increase in the State’s participation in the unusually high security costs of Israeli airlines, from the then current 60% to 65% (2011), 70% (2012), 75% upon the signing of an ‘Open Skies’ agreement between Israel and the European Community, and 80% upon implementation of that Open Skies agreement. Ultimately, in view of the great increase in the number of airlines, destinations, flight frequencies and capacity allowed by the Open Skies agreement signed on 10 June 2013 by Israel and the EU, and considering the contentions advanced by the management and worker unions of EL AL, Arkia and Israir, the Israeli government agreed in December 2013 to absorb 97.5% of the airlines’ security expenses retroactive to 16 July 2013 and going forward.

— Aircraft Protection Systems. The Israeli Government approved in 2009 a project for the installation of electro-optic protection systems in Israeli airline passenger aircraft and required all Israeii airlines to participate. These systems include anti-missile defenses. On 30 September 2014 the State agreed to finance the entire costs of installation, operation, maintenance and enhancements of the systems, which remain owned by the State and must be removed and returned to the State when an aircraft concerned is sold or retired. Thereupon EL AL entered into an agreement with Elbit Systems Electro-Optics for the installation of the protection systems, and EL AL has acted as a subcontractor for such installation in its own aircraft and those of other Israeli airlines.

Cargo

During 2010 – 2014 EL AL’s cargo division transported between 91 and 102 thousand tons of freight per year, a significantly lower volume than all but one of the 15 preceding years. This resulted mainly from increased competition from Cargo Airlines (‘CAL’) of Israel and foreign cargo airlines, and also from competing foreign passenger airlines that operated larger aircraft with greater cargo hold capacity. EL AL’s share of cargo transported in and out of Israel in 2014 was 34.2%.

By 2014, of the total cargo traffic at Ben-Gurion Airport, only 54% of freight was being carried in dedicated cargo planes, the remaining 46% being transported in the cargo holds of passenger aircraft. EL AL shared in this trend towards relatively lesser use of dedicated cargo aircraft. At the beginning of 2010, it only had two pure cargo aircraft, both 747-200 freighters, 4X-AXK and -AXL. It withdrew AXK from service in February 2010, replacing it two months later with a leased pre-owned 747-400 freighter, 4X-ELF (named ‘Hoopoe’ after Israel’s national bird). Then the freighter -AXL, the last 747-200 in EL AL’s fleet, was retired in November 2011, leaving EL AL relying on its single 747-400 dedicated cargo aircraft and the cargo holds of its passenger fleet.

Sun d’Or

Sun d’Or International Airlines, owned entirely by EL AL, was licensed in Israel for many years to operate charter flights, and more recently as a ‘Designated Carrier’ on regularly scheduled flights, to select destinations. It leased its aircraft from those in EL AL’s fleet and utilized EL AL personnel for its flight crews. In early 2011, however, Israel’s Civil Aviation Authority determined that Sun d’Or’s operations were not sufficiently independent from EL AL’s and therefore did not merit a separate operator’s license. Accordingly, it revoked Sun d’Or’s license effective 1 April 2011.

As a result, the three 757 aircraft leased by EL AL to Sun d’Or at the time were returned to EL AL, and 10 of the 11 appointments of Sun d’Or as a ‘Designated Carrier’ of Israel to specific destinations (all except the Eilat-Moscow route) were also transferred to EL AL. These destinations were Almaty, Antalya, Bratislava, Frankfurt, Lisbon, Minsk, Riga, Rostov, Sochi and Zagreb (on some of these, such as Frankfurt, EL AL already had Designated Carrier status).

Thereafter, Sun d’Or has continued to act as a tourism organizer and marketer of charter flights under the Sun d’Or brand, with the flights being carried out by EL AL (on weekdays) and by other airlines (on weekend and holiday fights).

(EL AL photo).

Israel Air Safety Rating

On 19 December 2008 the U.S. Federal Aviation Agency (‘FAA’) announced that it was lowering the flight safety rating of the State of Israel to Category 2. This refers to the level of civil aviation safety in Israel by Israeli aviation authorities including the Civil Aviation Authority of Israel (‘CAAI’). Although this FAA action was not directed at EL AL or other Israeli airlines, it resulted in limitations on airlines flying from Israel to the U.S., including restrictions on new routes, flight frequencies and other increased activity in the U.S. and on code-sharing agreements with U.S. airlines.

The CAAI then carried out the FAA’s requirements in order to have the original Category 1 certification restored. These included revising Israeli aviation laws= — accomplished by adopting a new 2011 Aviation Law and regulations. Also, the CAAI adopted a recertification process for EL AL’s operational activities and maintenance facilities, which was satisfactorily completed.

As a result, in November 2012 the FAA restored Israel’s flight safety rating to Category 1, the highest category. This allowed EL AL and American Airlines to resume the feature of their code-sharing agreement that allowed the American Airlines code to appear on flights carried out by EL AL (which feature had been suspended while the Category 2 rating was in effect). More significantly, EL AL could now consider anew adding destinations in the U.S., with Boston, Chicago, Miami and San Francisco continuing to be under consideration.

EL AL Serves Again as a Lifeline for Israel

In early July 2014 Hamas militants in Gaza resumed firing hundreds of rockets at Israeli population centers. Israel retaliated militarily by launching ‘Operation Protective Edge’ on 8 July 2014, and the war continued until a 26 August ceasefire. During 22-24 July the U.S. Federal Aviation Administration suspended all flights of U.S. airlines to and from Israel, and other foreign airlines did the same. Once again, EL AL was the only airline flying passengers and cargo in and out of Israel, serving as a lifeline to the State.

Labor Issues

The terms of employment of EL AL’s employees working in Israel (other than senior employees and workers covered by personal agreements) have long been mainly regulated by special collective agreements negotiated between the airline and the Histadrut Labor Federation on behalf of the various employee sectors. This system continued following EL AL’s complete privatization in 2005.

When EL AL was State-owned, it suffered periodically from employee slowdowns and strikes, and negotiations on renewals of the collective agreements were often difficult. Following complete privatization in 2005, agreement renewals tended to be negotiated smoothly. However, problems arose upon the expiration of the five-year agreement that ended 31 December 2012. Negotiations on renewal proved to be very difficult, and even two years later, at the end of 2014, no new collective agreements had been reached.

In December 2013 labor problems started in connection with pilots. On flights to certain destinations an unusual number of the pilots assigned to particular flights reported ‘illness’ preventing them from flying; and the standby pilots who would have been required to fly if the assigned pilot could not, also called in sick. On some days, disruptions occurred in the airline’s flight schedule due to shortage of pilots claiming illness, including delays and even the cancellation of several flight segments. Finally, on 11 May 2014 a memorandum of understanding was signed with the pilot representatives that called on EL AL to meet certain pilot demands while encouraging the pilots to comply with the airline’s flight scheduling.

Another issue involving the pilots arose when the International Civil Aviation Organization (‘ICAO’) issued a decision on 13 November 2014 whereby pilots above 65 years of age would no longer be allowed to fly aircraft on commercial flights. While Israel’s Aviation Regulations had a similar rule, the Director of the Civil Aviation Authority of Israel (‘CAAI’) would often issue exemptions allowing pilots over 65 to fly as co-pilots. Now, with the ICAO decision in place, the CAAI announced that such exemptions would no longer be granted and, moreover, the existing exemptions would be cancelled. The Israel Air Line Pilots Association brought suit to block the CAAI decision, and many EL AL pilots resumed their sanctions by, in effect, refusing to fly. The courts ultimately ruled against the pilots, but the grievances of some of the pilots continued. The next two years would see more severe labor problems involving EL AL and its pilots (see Chapter 12, in preparation).

Financial Results Continue Their Swings

During the first half of the 2010s, as in the preceding first five years of EL AL’s complete privatization, the airline’s annual financial results continued to swing between profits and losses.

2010 saw a net profit of $57.1 million, the second highest in EL AL’s history (next to 2005). Global aviation recovered from the recession of 2008-2009, with an 8.2% increase in passengers. EL AL enjoyed a 10% increase in passengers to 4.2 million – its highest ever. Despite increasing competition from other airlines arising from Israel’s more liberal aviation policy, EL AL’s market share of passengers at Ben-Gurion Airport held reasonably steady at 37.1%, versus 2009’s 37.5%.

In 2011 competition from foreign airlines started to take a significantly greater toll on EL AL. Aircraft capacity at Ben-Gurion Airport increased 9% in 2011 alone — greater than the 6.5% increase in the number of passengers, pressuring air fares downward. In the six years since 2005, seat availability of foreign airlines and the number of passengers flown by them to and from Israel more than doubled. Foreign airlines operating an international hub at their home airports were able to increase the number of passengers flown between Israel and a large number of destinations via indirect flights, taking advantage of their home country hubs and route networks and those of their airline partners in global aviation alliances – advantages not shared by EL AL. Accordingly, EL AL’s market share at Ben-Gurion Airport fell to 33.9% in 2011 (compared to 37.1% the preceding year). In addition, the average price in 2011 of aviation jet fuel, which is by far the largest component of an airline’s operating costs, rose by 41%, significantly raising EL AL’s operating expenses. Each one cent increase in the price of jet fuel increased EL AL’s fuel costs in 2011 by $2.3 million. Due to all the foregoing, the airline incurred a net loss of $49.8 million in 2011.

EL AL’s situation in 2012 remained similar to that of 2011. There was still a net loss, but it declined to $18.8 million. One of the factors affecting EL AL’s financial results each year is the exchange rate between the Israeli shekel and the U.S. dollar, because most of the company’s payroll is paid in Israeli shekels while its revenue is mostly in U.S. dollars. In 2012 the value of the shekel weakened against the dollar, thereby lowering EL AL’s salary expenses and helping to reduce its loss that year.

2013 saw a return to profitability, with a net profit of $25.4 million. The number of incoming tourists to Ben-Gurion Airport reached an all-time high of 2,580,000, while the number of Israelis travelling abroad also hit a record 4,276,000. That year EL AL flew a record 4.4 million passenger flight segments, and its percentage of available seats filled reached 82.9%, its second highest ever. Lower fuel prices, and reduced security expenses due to the government absorbing an increased share of the cost, also helped financial results. Market share, however, declined to 32.5% due to further increased competition from other airlines arising from Israel’s expanded ‘Open Skies’ liberal aviation policy.

2014 started off well. In the first half, Israel’s stable security situation continued, and tourists arriving in Israel by air increased 18% over the first half of 2013, with EL AL sharing proportionately in that growth. However, from 8 July to 26 August 2014 Israel was forced into a war against the Hamas militants in Gaza who had resumed launching rockets and missiles at Israel. In addition to the effects of the war on life and property, tourist traffic at Tel Aviv/Ben-Gurion Airport plummeted during the 50-day war and also declined in the remaining months of 2014, resulting in a 20% drop in tourism to Israel during the second half of 2014 compared to July-December 2013. EL AL estimated its losses at $70 million as a result of the war, and received no compensation from the Israeli government for the additional operating and security expenses it incurred. It ended 2014 with a net loss of $28.1 million, highlighting the effect on EL AL of geopolitical events beyond its control.

Leadership Change

On 2 December 2013 EL AL President Elyezer Shkedy announced that after four years of service as CEO of EL AL in which he felt ‘pride and tremendous satisfaction”, he intended to resign as soon as a successor is appointed. Shkedy regretted failing to put together a new collective labor agreement for staff following the expiration at the end of 2012 of the previous agreement. Like EL AL’s previous president Haim Romano, Shkedy and EL AL’s management battled with the airline’s many labor unions to reduce costs, but met stubborn opposition. Shkedy stated, ‘EL AL must reduce spending for the sake of a better future for its personnel and passengers, if it wishes to continue to grow and compete in the field of aviation, which is variable and challenging.” He also had led EL AL’s fight to at least modify the terms of Israel’s ‘Open Skies’ liberalization policy, contending that the reforms created an uneven playing field that would work against EL AL and Israel’s other two airlines, Arkia and Israir. Although the Israeli government proceeded to sign a very liberal ‘Open Skies’ agreement with the European Community in 2013, Shkedy was able to negotiate additional aid from the government to cover the Israeli carriers’ much higher security costs.

On 20 March 2014 David Maimon became President and CEO of EL AL, and Elyezer Shkedy’s four-year term of valuable service with the airline ended. Maimon had been with EL AL for nearly 10 years, starting as Vice President Customer Service in 2005 and then serving since 2010 as EL AL’s Vice President Commercial & Industry Affairs. Before then he served as CEO of the Servicemen’s Welfare Association of Israel.

At the end of 2014 a new collective labor agreement had still not been reached with EL AL’s labor unions. Nor had a decision been made on the choice of new long-haul aircraft for the greatly needed modernization of EL AL’s wide-body fleet. Both of these issues were to become major aspects of David Maimon’s term as President, and are covered in Chapter 12 of ‘EL AL: Israel’s Flying Star’.

Last updated 2 August 2023.

Copyright 2020-2023, Marvin G. Goldman.