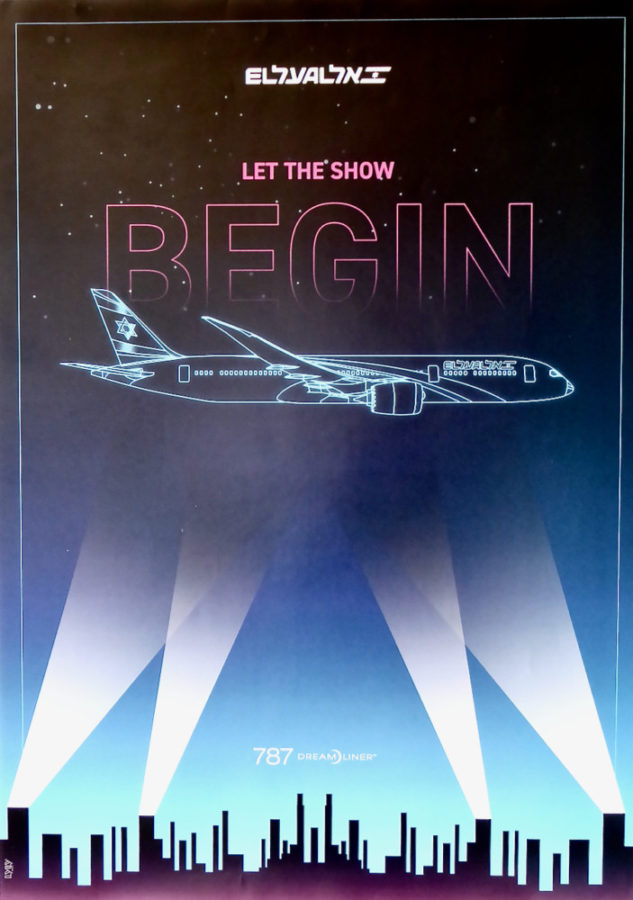

For several years before 2015 EL AL knew that it had to act soon to replace its wide-body long-haul Boeing 747-400 and 767-300 passenger aircraft. By 2015 the 12 aircraft of those types in its fleet averaged 20 years in age and were being eclipsed in operational efficiency by the Boeing 787 ‘Dreamliner’ and the Airbus A350. Finally, after much internal study, EL AL developed its ‘Wide Body Aircraft Acquisition Program’ and implemented it on 5 October 2015 by signing agreements with Boeing and certain lessors for the acquisition of up to 16 new Boeing 787 ‘Dreamliner’ aircraft, with options to acquire additional 787s.

Per those agreements, EL AL purchased from Boeing four new 787-9 aircraft, and five new slightly smaller 787-8s (two of which were to be sold to a lessor and leased back to EL AL). Also, EL AL contracted to lease six more new 787-9’s from lessors. The cost of these aircraft, plus their engines, advanced seats, entertainment systems and spare parts, reached over $1.25 billion dollars — the largest aircraft acquisition program in EL AL’s history.

Upon completion of those purchase and lease agreements, EL AL would have 15 787s (seven owned and eight leased), with all aircraft to be delivered during 2017 through 2020. The 787s would replace the entire 747-400 and 767-300 fleet.

At the same time EL AL acquired options from Boeing to acquired additional 787 aircraft of the larger 787-10 type (with the right to convert into other 787 types), provided the delivery dates are no later than 31 December 2023. If these options were exercised, they would serve to replace all or part of EL AL’s wide-body 777-200 fleet.

In February 2016 EL AL contracted with Rolls-Royce for the purchase of advanced ‘TRENT-1000 TEN’ engines for the 787s ordered by the airline.

Dreamliner Features

The Boeing 787-9 ‘Dreamliner’ is a two-engine, wide-body (two-aisle) aircraft with a superior range of 8,665 miles ((13,945 km), allowing it to fly nonstop to virtually any destination in the world. It features a revolutionary design that includes the use of lightweight carbon fibre composite materials which make up 50% of its fuselage, wing and other primary structure. Also, the modern architecture of the 787’s operating systems is simpler, more functional and more efficient than that of earlier models.

Moreover, the advanced structure of the 787s allowed Boeing to modify the interior cabin air pressure so that passengers feel they are flying at a lower altitude than on earlier models and the air is less dry. This makes the ride more refreshing, restful and comfortable, especially over long distances. The windows are also much larger and the light they admit is adjustable, while the entire aircraft has mood lighting conformable to the time of day and activity level.

The 787-9 is nearly the same size as the 777-200s in EL AL’s fleet. The 787-8 is about 10% shorter than the 787-9 model. Each of those types is smaller than EL AL’s 747-400s. However, the most advanced wide-body aircraft with two engines, the Boeing 787 and Airbus A350, due to the proven reliability and greater fuel efficiency of their aircraft engines and their advanced structural design, have become more popular than four-engine larger aircraft like the Boeing 747 and Airbus A380. On fuel savings alone, for example, a 787 flying between Tel Aviv and New York can achieve a fuel saving of up to 47% compared to a 747-400. Overall, EL AL expects a 15% to 20% savings in total operational and maintenance costs from the replacement of its 747-400s and 767-300s with its new 787 Dreamliners.

Preparation for 787 Operations

With EL AL’s first 787 due for delivery in Summer 2017, all divisions of the airline participated for over 1-1/2 years in a comprehensive ‘Dreamliner Administration’ project to prepare for the introduction of the 787s into the fleet. This included pilot qualification, cabin crew familiarization and training, maintenance instruction, selection of the interior seating, design and entertainment systems, publicity, etc.

before delivery to EL AL, 27 July 2017.

Interior of EL AL’s 787s

EL AL’s 787s feature three classes of service — ‘Business First’, ‘Premium’ and ‘Economy’. The ‘Business First’ Class provides maximum comfort and privacy, with advanced full flat bed seats by Recaro, a leader in aircraft seating. Following the trend of other airlines, First Class was eliminated, and the new ‘Business First’ is close to First Class in quality.

The Premium Class is new for EL AL, and its introduction also follows a trend among airlines with long routes. Its quality is between Business and Economy, and the rows have 2-3-2 seating.

The 787-9s as delivered featured 32 ‘Business First’ seats, 28 Premium Class seats, and 215 Economy seats. However, due to higher than expected demand for the Premium Class seats, another Premium row was added starting in 2019, increasing their number to 35, while retaining 32 seats in Business First and reducing Economy to 204, for a total of 271 seats. The smaller 787-8s each have 20 Business First, 35 Premium and 183 Economy seats, for a total of 238.

All seats in all 787 classes feature large high definition screens, a new advanced eX3 inflight entertainment system by Panasonic Avionics with an amazing amount and variety of audio-visual content on demand, and access to high speed internet by ViaSat and USB connections. The entertainment system gives each passenger a choice of 125 movies, 500 hours of TV streaming, 100 hours of children’s TV, 650 albums and music channels across 25 different categories, radio stations, podcasts ad audio books, plus a selection of games, newspapers, magazines, travel guides, etc.

The Dreamliners Arrive

On 22 August 2017 EL AL took delivery of its first Boeing ‘Dreamliner’ aircraft, a 787-9 registered 4X-EDA. Each EL AL 787 is named after a city in Israel, and 4X-EDA is named ‘Ashdod’. Following a festive delivery reception at Boeing in Everett, Washington, and a nonstop 6,746 mile (10,856 km.) delivery flight from Paine Field, near Boeing’s production facility in Everett, EL AL’s first Dreamliner landed at Tel Aviv’s Ben-Gurion Airport on 23 August 2017, greeted by a traditional water cannon salute.

In a welcoming ceremony at EL AL’s home base at Ben-Gurion Airport, attended by EL AL management and employees, government officials and other dignitaries, EL AL’s President David Maimon stated: “The arrival of the first Boeing 787 Dreamliner is a day of pride and joy to all of us at EL AL. It is the highlight in the ongoing renewal of the EL AL fleet, which started a year and a half ago when we decided to order 16 Boeing 787 Dreamliners. … The arrival of the new airplanes will create a revolution in the customer experience. We have set a very high standard of service and product excellence in order to maintain our position as the first and preferred choice for passengers, travelling both to and from Israel. I am convinced that this significant procurement of 787s is a great opportunity for us to meet the highest levels expected. The Dreamliner will ensure our customers receive exceptional comfort, innovative technology, advanced aircraft and quality service.”

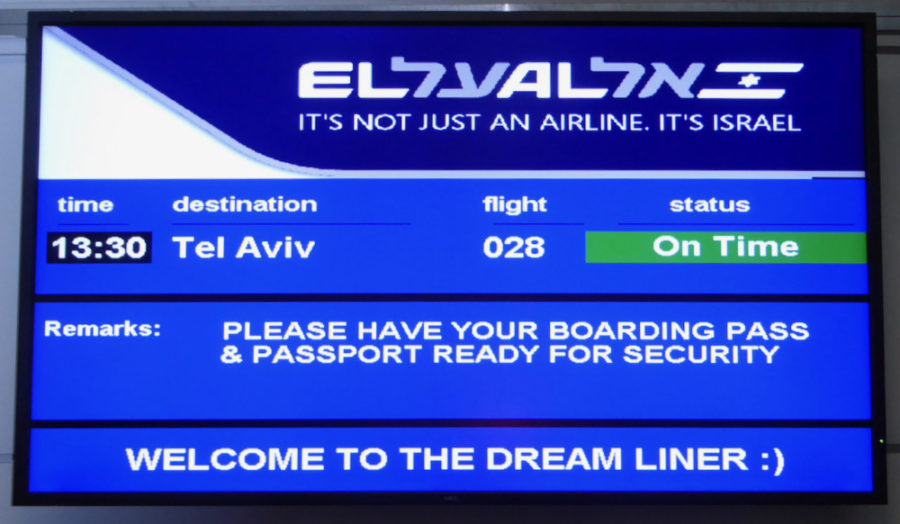

EL AL utilized its first 787-9, 4X-EDA, to operate its inaugural scheduled 787 flight — to London on 12 September 2017. Its second 787-9, 4X-EDB, was received on 8 October 2017. With two 787s in service, EL AL inaugurated 787 service to the U.S., the first flight being a roundtrip to the New York area’s Newark, New Jersey, airport on 17 October 2017.

Continuing with its Dreamliner deliveries, EL AL received five more 787-9s in each of 2018 and 2019, and its first two 787-8s in 2019 — bringing its total 787 fleet to 14 aircraft by the end of 2019.

Ownership and Management. During 2015 – 2019 EL AL continued to be controlled by Knafaim Holdings, which in turn was controlled by members of the Borovich family. At the end of 2019 EL AL’ shares of stock were owned as follows: Knafaim – 38.33%; Phoenix Group – 9.65%; Ginzburg Group – 7.97%; and various smaller shareholders in the public – 44.05%. On 1 June 2017 Eli Defes was appointed as Chairman of the Board of Directors, replacing in that position Amikam Cohen who continued to serve as a Director.

In November 2017 David Maimon, EL AL’s President and CEO for nearly four years, tendered his resignation and agreed to stay on in his position until the appointment of a successor. He was at EL AL for 13 years in total and led the airline in its procurement of 16 Boeing 787 Dreamliner aircraft.

On 15 February 2018 EL AL’s Board of Directors appointed Gonen Usishkin as President and CEO. Usishkin served as a pilot in the Israel Air Force and earned a Master of Business Administration degree from Tel Aviv University. He joined EL AL in 2004 and served six years as a pilot on EL AL’s 747s. He then moved over to EL AL management, served as Director of Commercial Planning, and was Vice President-Commerce & Industrial Affairs at the time of his appointment as President. His first two years as President were characterized by the introduction of 13 of EL AL’s 16 Boeing 787s into its fleet and by the opening and planning of several new destinations for EL AL flights.

EL AL Retires Its Wide-body 767-300s and 747-400s

At the end of October 2015, following EL AL’s order for new 787 Dreamliners, it still had six passenger 747-400s and seven 767-300ERs in its fleet averaging 20 years in age. With the arrival of the first two 787-9s in 2017, it withdrew two 747-400s (4X-ELE and -ELH) from service that year. In 2018, with the arrival of five more 787-9s, EL AL retired four of its 767-300ERs, 4X-EAK/EAN/EAP/EAR.

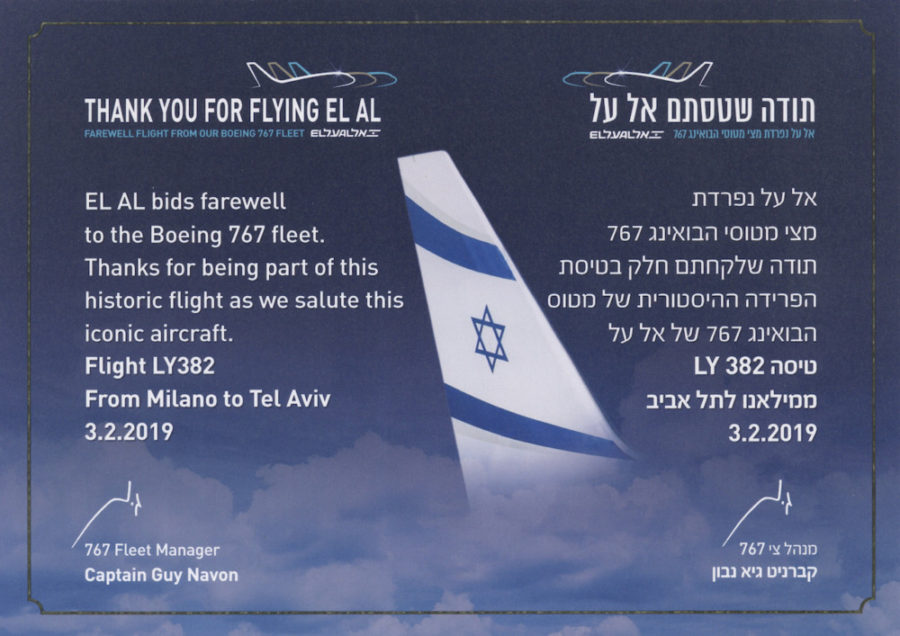

Finally, benefiting from the arrival in 2019 of five more 787-9s and its first two 787-8s, EL AL retired its last three 767-300ERs, 4X-EAJ/EAL/EAM, with its last 767-300ER flight being operated by 4X-EAJ from Milan to Tel Aviv on 3 February 2019.

(Sivan Farag photo)

(MGG collection)

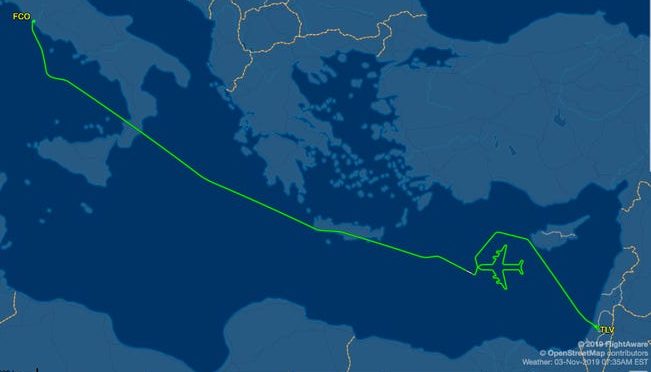

EL AL also retired in 2019 its last four passenger 747-400s, 4X-ELA/B/C/D, with its final 747-400 flight being operated by 4X-ELC with great fanfare from Rome to Tel Aviv on 3 November 2019.

(Image courtesy of Flight Aware)

EL AL had also been operating one remaining pure cargo aircraft, a leased Boeing 747-400F, 4X-ELF. Due to the retirement of its 747-400 fleet, EL AL decided to withdraw that remaining 747-400 freighter from service in July 2019 and to transport its future cargo in a ‘wet-leased’ aircraft (that is, leased aircraft and crew) in lieu of a dedicated cargo aircraft, in addition to carrying cargo in the large bellies of its expanded wide-body aircraft fleet.

For the time being, EL AL retained its six 777-200ER wide-body aircraft, averaging 17 years in age at the end of 2019, although these were slated for eventual retirement in future years when additional 787s were expected to join the fleet.

The Narrow-body Fleet of 737-800/900s

In 2015, in contrast to EL AL’s wide-body fleet which needed and received urgent renewal as described above, its narrow-body (single-aisle) short and medium-haul fleet was in relatively good shape. It consisted of 15 Boeing 737-800s averaging 11 years in age and, more significantly, five 737-900ER aircraft that arrived new from Boeing in 2014-2015, while three more -900ERs were being delivered new in 2016. These 737s mainly serve EL AL’s many destinations in Europe. Two of the 737-800s have usually been operated under EL AL’s Sun d’Or brand.

(Rami Mizrachi photo, CC-BY-SA 4.0, Wikimedia Commons)

With the arrival of the 737-900ERs, EL AL retired in early 2016 its only two 737-700s which were smaller and less economical aircraft. At the end of 2019, the airline’s narrow-body fleet consisted of the eight recently acquired 737-900ERs (all owned) and 16 737-800s (6 owned and 10 leased).

In total, counting both EL AL’s wide and narrow-body aircraft, its fleet increased from 39 at the beginning of 2015 to 43 at the end of 2019.

Route Developments

During 2015 – 2019 EL AL continued to be an all point-to-point airline; that is, all its regularly scheduled passenger flights were operated nonstop to its various destinations. In 2015 EL served passengers with about 34 destinations in 25 countries, and it 2019 it operated to about 40 destinations in 26 countries. This included at the end of 2019 28 destinations in Europe, (the main ones being London, Paris, Amsterdam, Moscow, Frankfurt, Rome, Milan, Madrid and Zurich); eight in the US and Canada, and five in Asia/Africa (Bangkok, Beijing, Mumbai, Hong Kong, and Johannesburg). In all, EL AL operated an average of 294 round trip flights each week during 2019 (including all its passenger aircraft and its one dedicated cargo plane).

The main route expansion during this period was to the U.S. In addition to its long-standing routes to New York, Newark and Los Angeles, EL AL added five renewed or brand new U.S. destinations. It resumed service from Tel Aviv to Boston, Massachusetts in June 2015 and to Miami, Florida on 1 November 2017. With the arrival of additional 787 Dreamliners it launched three new U.S. destinations — San Francisco, California on 13 May 2019, Las Vegas, Nevada on 14 June 2019, and Orlando, Florida with seasonal summer service in summer 2019.

1 November 2017. (MGG collection)

Within Europe, EL AL resumed service in its own name to Lisbon, Portugal in October 2018; Nice, France in March 2019; and Manchester, U.K. on 26 May 2019 — in each case replacing flights operating under its Sun d’Or brand). On the other hand, the route to St. Petersburg, Russia ended on 18 January 2015 due to insufficient commercial justification.

Meanwhile, new scheduled destinations marketed under EL AL’s Sun d’Or brand were launched starting in 2015 to Napoli, Italy; in 2016 to Grenoble, France; Stuttgart, Germany; Tlibisi, Georgia; and Valencia, Spain; and in 2019 to Catania, Italy; Salonika, Greece; and Dubrovnik, Croatia. All Sun d’Or-branded scheduled flights were in addition to its main activity of marketing charter flights under the Sun d’or-brand to many different vacation, seasonal and customized destinations. During 2019 Sun d’Or marketed nearly two thousand ‘Sun d’Or’ flights to 60 destinations in Europe and Africa.

In 2019 EL AL announced its intention to start routes to several new destinations, including Tokyo, Japan; Chicago, Illinois, U.S.; Dublin, Ireland; and Dusseldorf, Germany, and it began preparations and extensive publicity for their launch. However, due to the Covid-19 crisis (see Chapter 13, in preparation, covering 2020-on), these new routes had to be postponed.

Competition, and More Competition

Implementation continued of the June 2013 ‘Open Skies’ agreement between Israel and the European Union. Upon completion of its last stage in 2019, the agreement effectively removed all limits on the frequencies and capacity of flights between EU member countries and Israel. This led to a significant increase in the supply of flights and seats offered by airlines flying to Israel and, since the supply exceeded market demand, airfare prices dropped in order to fill those seats, resulting in a significant rise in passenger traffic on routes between Europe and Israel.

Nor was this liberalization of aviation policy limited to the countries in the European Union. During 2015 – 2019 the Israeli government continued to sign new or amended aviation agreements with several other countries, designed to increase the number of airlines and their frequencies and available seats between those countries and Israel. These included agreements with Canada, China, Chile, India, Japan, Thailand, Australia, and the U.K. (to be effective upon completion of the Brexit process).

In all, the number of incoming tourists to Israel at Ben-Gurion Airport increased from 2.5 million in 2014 to 4.0 million in 2019 — a 60% increase; and the number of Israeli tourists traveling to other countries increased from 4.7 million in 2014 to 8.3 million in 2019 — an increase of 77%.

The increase in tourism to Israel definitely benefited the economy of the State of Israel, although the increased outflow of tourism by Israeli residents offset that to some extent. Certainly the lower airfare prices from intense competition helped the average traveler. As to EL AL, however, while the number of passengers it carried each year rose from 4,595,000 in 2014 to an all-time high of 5,826,000 in 2019, an increase of 27%, this was much lower than the 71% increase in travelers at Ben-Gurion Airport during that period. As a result, EL AL’s market share of passenger traffic at its home base, Tel Aviv’s Ben-Gurion Airport, fell from 33.3% in 2014 to 24.6% in 2019.

During 2015 – 2019 EL AL had to compete with about 100 airlines operating passenger flights at Ben-Gurion Airport. About 65 of them were foreign airlines operating scheduled flights (some of which also carried out charter flights); about an additional 35 airlines operated charter flights (some of which carry them out on a regular basis); and two were other Israeli airlines, Arkia and Israir.

Competition during this period was particularly fierce on routes to the East and from ‘low-cost’ airlines on routes to Europe. On routes to India and the Far East, foreign airlines have a competitive advantage because EL AL has been prevented from flying directly East over certain Arab and Muslim countries and must take longer and costlier routes to reach India, China and Thailand. On rotes to Europe, ‘low cost’ airlines flying to Tel Aviv have proliferated. These airlines have a low expense structure arising mainly from direct online marketing rather than marketing through distribution systems and travel agents, extensive use of secondary airports and uniform aircraft fleets fitted with as many seats as possible allowing a reduced cost per seat, and minimum amenities during the flight. This expense structure allows these airlines to offer a basic seat at very competitive prices. As a result, the market share of ‘low-cost’ airlines at Ben-Gurion Airport rose to nearly 23% in 2019, led by WizzAir of Hungary with a 5.3% market share, easyJet of England with 4.9%, and Ryanair of Ireland with 3.3%, respectively serving 17, 15 and 20 destinations in Europe nonstop from Tel Aviv.

Meanwhile, the large ‘legacy’ airlines, like British Airways, Air France-KLM, Delta, Lufthansa, Swissair, Turkish, United etc. have the competitive advantage of participating in huge global alliances whereby they can offer passengers hundreds of destinations from Tel Aviv, utilizing their hubs in their home countries for stopovers or for connections with their airline partners. In contrast, EL AL has had limited opportunity to offer stopover flights from its home airport of Tel Aviv since for political reasons almost all Arab countries have prevented EL AL from flying over their air space thereby depriving the airline of attractive flight routes to the East.

A prime example of the unequal competition facing EL AL is the case of Air India which launched flights from India to Tel Aviv on 22 March 2018. Whereas EL AL’s route to India must take a circuitous flight path because it is prevented from flying over Saudi Arabia, Air India obtained Saudi permission to pass through Saudi airspace direct to Tel Aviv (and Israel approved that routing), thereby saving Air India over two hours in flight time, making the flight more attractive for passengers. and lowering its fuel and other costs. EL AL objected to the Israeli government, saying that the government had pledged to ‘encourage fair and healthy competition’ between Israeli airlines and foreign competitors, and that allowing foreign airlines to operate flights to and from Israel on routes that EL AL is not permitted to fly, amounts to unfair competition. However, its objections made no headway, and its market share on the route to India fell significantly.

Cargo Competition. Because foreign airlines have steadily increased their frequencies and aircraft size on flights to Tel Aviv, they have strengthened their competition with EL AL not only in passengrer traffic but also by transporting more cargo in the greater belly space of their aircraft. EL AL also competed during 2015 – 2019 with operators of pure cargo aircraft including CAL Cargo Airlines of Israel and about nine foreign airlines utilizing dedicated freighters. As a result, although total cargo volume at Ben-Gurion Airport rose from 2014 to 2019, the volume of cargo carried by EL AL fell from 91,100 tons in 2014 to an all-time low of 74,500 tons in 2019, and EL AL ceased reporting its cargo operations as a separate segment in its financial statements starting in June 2018.

Countering the Competition

Fleet Modernization. To compete effectively, EL AL finally took the necessary steps during 2015 – 2019 to modernize its wide-body, long-haul fleet. It signed agreements in 2015 to acquire 16 new 787 ‘Dreamliner’ aircraft, Boeing’s most modern and efficient wide-body plane, and the first 14 were delivered to EL Al, and placed in service, between summer 2017 and the end of 2019. The 787 interiors also featured a major improvement over EL AL’s previous aircraft types, with advanced seats and an outstanding in-flight entertainment system at each seat. The 787 Dreamliners allowed the airline to retire its aging 767-300 and 747-400 aircraft types.

Meanwhile, EL AL completed in 2016 its acquisition of eight new narrow-body short and medium-haul Boeing 737-900ERs. Also, EL AL continued its program of upgrading the seats and interiors of its other aircraft types. In 2015 new improved First Class and Business Class seats were installed in its 777s, and In 2019 EL AL completed its project of renovating and upgrading the interior of its 737-800s, including installation of new advanced seats in all service classes.

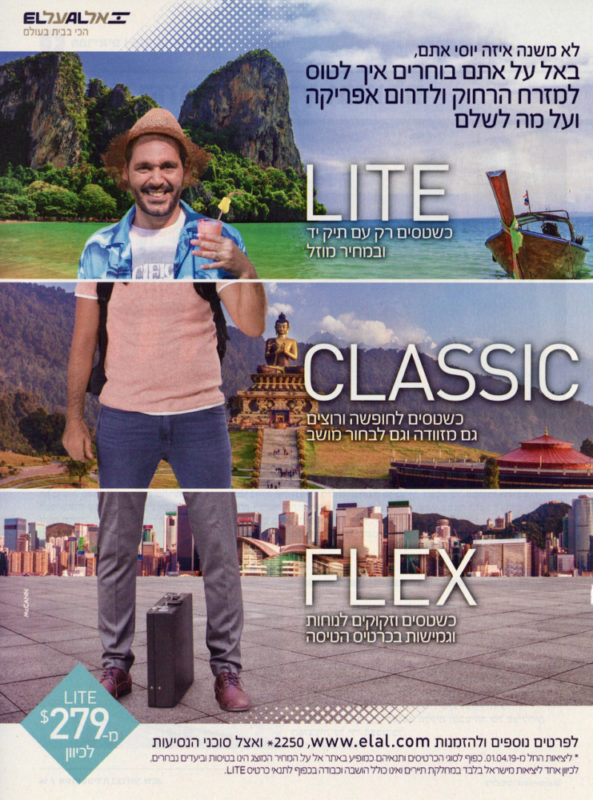

Meeting the ‘Low-Cost’ Airline Challenge — the ‘New Fare Plan’. In 2013, in an effort to counter the expansion of ‘low-cost’ airlines flying to Israel, EL AL launched its ‘UP’ brand, described in the preceding chapter. EL AL aircraft, painted in a special ‘UP’ color scheme operated to five European cities, with a low basic fare and extra charges for seat selection, baggage, meals, etc., similar to what the ‘low-cost’ airlines were doing. However, while the flights proved successful, EL AL found the separate brand arrangement to be too limiting and unwieldy. In October 2018 it discontinued the ‘UP’ brand and merged the ‘UP’ operations back into its mainstream fleet. At the same time, to retain the option of a basic low fare to complete with the ‘low-cost’ airlines, and consistent with global aviation trends and operational streamlining, EL AL introduced a ‘New Fare Plan’ for Economy class in flights to Europe, and extended it to the Far East and South Africa in April 2019.

The New Fare Plan gives Economy Class passengers the option to choose from three different types of flight product packages.

— The ‘Lite’ ticket is the most basic and cheapest product, similar to that offered by ‘low-cost’ airlines. It allows passengers to board the aircraft with hand baggage and a handbag and receive a meal, with a fee for changes but no cancellation option (subject to limited exceptions). It does not include seat selection or checked baggage.

— The Classic’ ticket allows passengers, in addition to the above, to select their seats (other than preferred seats which cost extra), check baggage to the belly of the aircraft, and make changes or cancellations for an extra fee.

— The ‘Flex’ ticket, in addition to the foregoing, allows passengers to board with a second handbag and send additional luggage to the belly of the aircraft, choose their seats including preferred seats subject to availability, and enjoy flexibility on the terms of flight changes and cancellations.

With this plan, EL AL offered a wider range of choices for passengers in terms of cost, comfort, amenities and flexibility — from ‘Lite Economy Class’ to ‘Business Class’ — without the need for a separate brand and operation.

Customer Digital Experience Upgraded. During 2015 – 2019 EL AL enhanced the user’s experience on the airline’s website and mobile application. After a series of incremental improvements, a major advance occurred in early 2019 with the launch of a new booking engine on both the EL AL website and mobile app. On each platform the user can purchase flight tickets, manage their flight (including seat and meal selection, flight status and tracker), inquire on their ‘Matmid’ frequent flyer club points and claim awards, pay for airline tickets and related products with money or a combination of money and frequent flyer points, view special offers dedicated to the customer and notices of many other issues (such as the recommended time to leave for the airport, destination weather forecasts, etc.), and check in. EL AL sales through its website and mobile app continued to grow in double digits during this period. For example, website sales in 2019 increased over the year before by 24.5%.

Schedule and Pricing Management Improved. EL AL continued to use the ‘Amadeus’ computerized travel technology system for its booking, flight management and check in. In 2016 the airline completed new internal projects for distributing its schedule and changes directly to the Amadeus system, and for updating and adjusting prices of flights per market demand and supply. It also introduced more advanced tools to manage all passenger revenue from flights and accompanying services.

Codeshare Agreements.

As EL AL is not a member of one of the global airline alliances (One World, Sky Team, Star Alliance) due to security and other reasons, it has resorted to codeshare agreements with other airlines in order to provide better connectivity and other benefits for its passengers. A codeshare agreement between airlines allows them to mutually sell seats on certain flights. One airline acts as marketer and the other as operator of a particular flight, using the activation code of each airline. This allows an airline to expand its flight frequencies to a destination it serves or to provide a nonstop or connecting flight to a destination it does not serve, all in coooperation with its airline partner in the codeshare. There are also marketing advantages, including amplifying the attractiveness of joining the participant’s frequent flyer program.

During 2015 – 2019 EL AL implemented several additional codeshare areements. Among them, in November 2015 EL AL’s codeshare agreement (signed in 2014) with U.S.-based JetBlue Airways entered into effect, allowing EL AL passengers to purchase combined flight tickets under the EL AL flight code, with connection flights via New York JFK, Newark and Boston airports to numerous JetBlue destinations across the U.S. In May 2019 EL AL signed a codeshare agreement with Alaska Airlines, allowing between them certain connection flights in the U.S. and frequent flyer club sharing.

As of the end of 2019, in addition to its codeshare agreements with JetBlue and Alaska Airlines, EL AL had codeshare agreements with Aero Mexico, Aerolineas Argentinas, Air China, American Airlines, Bangkok Airways, Ethiopian Airlines, Hong Kong Airlines, Iberia, LOT Polish Airlines, Qantas, S7 (Siberia) Airlines, Swiss International Air Lines, TAP Air Portugal, Thai Airways and Vietnam Airlines.

Frequent Flyer Program (Matmid)

In 2019 EL AL further enhanced its ‘Matmid’ frequent flyer program by expanding its point redemption options. Points could now be used to pay for travel on connecting flights operated by codeshare airlines, or for ancillary charges like excess baggage fees or preferred seating, or to pay for tickets with a combination of money and points. It also changed the point accumulation model to base it on financial expenditure (with a few exceptions) as opposed to being based on flight destination and fare class.

From the beginning of 2015 to the end of 2019 the number of members in EL AL’s Matmid program rose by about one-third to reach 2.3 million.

— Flycard. Flycard is EL AL’s branded credit card program available to persons having a bank account in Israel. Purchases made by the holder of a Flycard earn points in EL AL’s Matmid frequent flyer program. At the end of 2018 EL AL expanded its cooperation with credit card companies, adding Mastercard, while also partnering with Diners and American Express in its Flycard program.

Operational Technology. In March 2017 EL AL launched ‘AMOS’, an advanced statistical software program developed by Swiss-AS for increasing efficiency and cost control in aircraft maintenance. To further cope with competition, EL AL adopted in 2018 a strategic plan called ‘Ofek 2021’ designed to streamline its operational processes and increase sources of revenue, and in 2019 it started a multi-year program to replace several operational and commercial information systems and improve logistic work processes. The latter included, for example, its launching in May 2019 a modern logistics center for spare parts maintenance.

Israir Acquisition Attempt. On 2 July 2017 EL AL and its subsidiary Sun d’Or signed an agreement with IDB Development, ITB Tourism (2009) (an IDB subsidiary), and Israir Aviation and Tourism, whereby EL AL would acquire Israir. Among other activities, Israir operates one of Israel’s two much smaller airlines that compete with EL AL (the other being Arkia). The transaction was subject to the approval of Israel’s Antitrust Authority and, unfortunately, on 20 January 2018 the Antitrust Authority blocked the transaction and it was never consummated. The result was similar to the situation in 2005 when the Borovich family’s company Knafaim, that controlled Arkia at the time, was forced by the Israel Antitrust Authority to sell their holding in Arkia when Knafaim acquired control of EL AL that year.

Security and Safety First.

EL AL is widely recognized as the outstanding model on providing security for its flights and passengers. Its standard policy is not to comment on any of its security systems or procedures. Nevertheless, several of its techniques are publicly known. To start, EL AL security personnel receive much more comprehensive instruction than usual, including several weeks of special classroom training and apprenticeship in an airport. They are very well paid, in order to attract top people.

Passengers receive a far more in-depth interrogation than from other airlines. EL AL security agents, specially trained to detect suspicious answers, ask detailed careful questions on the purposes of one’s trip and packing and handling of luggage. Passengers traveling together are questioned separately by personnel who look for conflicting stories or suspicious details, like tickets bought with cash, or visas from countries linked to terrorism. Every passenger’s name is also run through a computer check to detect any security concerns before being allowed to board.

Profiling of passengers is also deemed necessary to ensure an appropriate level of security. The importance and success of this approach has been proven time and again. For example, in a notorious case at Heathrow Airport in 1986, a 32 year old Irishwoman, Anne-Marie Murphy, tried to board an Israel-bound EL AL flight. The EL AL ticket and security agents thought it unusual for a pregnant young woman to travel alone, to meet her Jordanian fiancé, and have no luggage except a carry-on bag, while saying she was going to stay at a hotel for a week. Her handbag was emptied and X-rayed, and they detected a false bottom with gray material beneath it. Unknown to the traveler, her boyfriend had packed the bag with explosives that authorities said would have detonated in flight, likely killing all aboard. The profiling worked, thwarting a catastrophe.

Luggage on EL AL flights is also subjected to special security measures. These include placement in decompression chambers at certain airports prior to takeoff, and checks with other more sophisticated equipment and software, to detect dangerous items, including explosives that could detonate by altitude-sensitive triggers or barometric fuses. Every bag is matched to a passenger. Cargo is routinely checked in preflight decompression chambers.

The airport itself is part of the security process. EL AL security personnel guard its aircraft on the ground at all hours, including when it undergoes maintenance, which is typically done by EL AL’s own employees. They also check suppliers and personnel routinely servicing the aircraft. At Ben-Gurion Airport, entering vehicles are screened, and the airport runways have a system to detect unsupervised entry of vehicles and airplanes onto runways and alert air traffic control in the control tower.

Aboard each EL AL aircraft, one or more armed ‘sky marshals’ rides as added protection, and flight attendant training includes security matters. The cockpit doors are reinforced steel that can only be opened from inside the cockpit, and entry is only through a keyless double-door system. The cargo holds are also reinforced, and it has been reported that EL AL aircraft are reinforced by armor plating that would prevent bullets or grenade fragments from piercing the fuselage and limit the impact of an explosion.

It is reported that EL AL protects at least certain of its aircraft with anti-missile systems that can detect any approaching heat-seeking missile and respond automatically within seconds to confuse the missile and divert it from the aircraft. These systems are under constant development and technological improvement by Israeli firms. Presently EL AL is continuing to install protection systems on its aircraft and those of other Israeli airlines as a subcontractor to Elbit Systems Electro-Optics Elop Ltd.

The costs of EL AL’s extraordinary security are high—for 2019 they reached $170 million. Historically the Israeli government has covered between 50 and 100 percent of the security costs of EL AL, and presently it covers 97.5 percent.

In sum, security at EL AL is a complete system, from the detailed training of specialized personnel, to the airport environment, to the aircraft on the ground, to the careful screening of passengers, luggage and cargo, and to the aircraft in flight. The significant added costs are deemed to be well worth it, for the benefit of both the airline and its passengers.

Cybersecurity is also a top priority at EL AL. In 2019 it continued to significantly expand its operations in information security and defense against cyberattacks. This included investments in security tools and surveys, implementation of protection using attack tools, exercises and training, updates of policies and procedures as well as enhancement of information security in its offices in Israel and abroad. In addition, the airline carries out extensive activities of identifying and defining the cyber threat as a basis for multi-year work plans .

Limitations on Flights on Shabbat and Certain Holidays. For several decades while owned by the Israeli government, and even after its complete privatization in 2006, EL AL has maintained a policy of not operating scheduled passenger flights on Shabbat (the Jewish Sabbath from Friday sundown to Saturday sundown) or on major Jewish holidays. Flights during those days have been limited to all-cargo flights (typically with leased dedicated cargo aircraft) and to charter flights operated under the Sun d’Or brand (typically limited to two aircraft or leased foreign aircraft). Moreover, from mid-January 2021 all Sun d’Or-branded flights on those days also have been completely eliminated. As a result, EL AL grounds its fleet for about 59 days a year and has been called the ‘306-day-a-year airline’. In contrast, EL AL’s main competitors do operate scheduled and charter flights to and from Tel Aviv on those days.

Some reports estimate that this policy costs EL AL millions of dollars annually in lost revenue, Nevertheless, the prevailing view at EL AL continues to be that the absence of scheduled passenger operations on Shabbat and major Jewish holidays is a matter of customer service and respect, particularly for EL AL’s large number of religious Jewish travelers.

Labor Relations. The terms of employment of EL AL’s employees in Israel (other than senior management and officers and those employed under personal contracts) are regulated to a great extent by special collective agreements signed from time to time between the airline and the New General Workers’ Union (the New Histadrut). Among these complex union agreements are nine different main ones, separately covering ‘permanent’ employees, certain categories of employees hired on or after 1 January 1999, employees hired before 1 January 1999, flight attendants hired during certain periods, ‘temporary’ employees, engineers and architects, maintenance employees, avoidance of certain preferences to different sectors, and severance pay deposits. The agreements have provided important protections for employees and stability in the workforce. On the other hand, the multiplicity of agreements for different categories and their terms have reduced management’s flexibility in operations and in optimizing the number of employees, which in turn has diminished EL AL’s competitive position versus other airlines that do not have such constraints and related costs.

Most of these agreements have expiration dates, and over the years difficult negotiations have occurred among union representatives, different employee worker groups, and the airline on the terms of agreement renewals or changes. When the expiration date of 12 December 2012 occurred, it took until June 2015 for the airline to reach an interim agreement with the labor representatives that would eventually apply through 2018 with a later extension through the end of 2019. However, that 2015 interim agreement did not solve labor relations problems that had arisen with some of the airline’s pilots.

The rapid expansion of air travel in the 2010s led to increased demand for pilots and a global shortage of qualified pilots that continued until the Covid-19 pandemic in 2020 curtailed flights. At EL AL the difficulties with certain pilots started in 2013. An unusually large number of pilots assigned to flights, as well as their backup standby pilots, reported that they could not perform the flight because of ‘illness’. This disrupted the airline’s flight schedule and at times required flight cancellations. Negotiations with pilot representatives in the workers’ union continued, and court and arbitration proceedings took place. Numerous issues were involved, including compensation, operational efficiency, training, flight staffing, and employee benefits.

An additional issue arose in 2014 when the International Civil Aviation Organization announced a new regulation whereby pilots above age 65 would no longer be allowed to fly aircraft on commercial flights, and Israel’s Civil Aviation Authority determined that it was bound to follow that regulation. This particularly affected veteran EL AL pilots because those over 65 had in the past been allowed to continue flying as secondary pilots (not as captains), and the new regulation meant they could not fly at all. This, too, led to administrative and labor court proceedings regarding the effect of these changes on pilots over 65, but without a definitive resolution.

The labor disputes with pilots escalated and became critical in 2016. By then, in addition to excessive ‘sick’ notes, some pilots outrightly refused to man flights, whereas others would agree to man a flight one-way only while be paid for returning as a passenger in Business Class.

To counter the lack of pilots to staff certain flights, and to maintain its schedule as much as possible rather than cancel flights, EL AL entered into ‘wet leases’ with certain foreign airlines that specialized in that form of leasing. In a ‘wet lease’, the foreign airline supplies not only the aircraft but also its pilots and cabin crew who were usually from the foreign airline’s host country. The aircraft would typically have a nondescript generic appearance inside and out. Security and ground services were handled by EL AL staff. Two EL AL Hebrew-speaking flight attendants were typically on board to assist passengers, and EL AL meals and amenities were provided. In 2016 for example, EL AL ‘wet leased’ aircraft and crew as needed from Privilege Style Airlines of Spain (777-200, 767-300 and 757-200 types) and Hi Fly airlines of Portugal (Airbus A330 type). The situation became so bad in late 2016 that EL AL actually had Privilege Style base the wet-leased aircraft in Israel to be ready for use at the very last moment in case neither the assigned EL AL pilots nor any replacements made themselves available for a flight.

Of course, the continuing labor dispute with the pilot representatives in the workers union, and the related disruptions of EL AL flights and wet-leasing of aircraft and crew of foreign airlines served no one’s best interest (except that of the foreign airline). EL AL’s costs increased greatly and its reputation suffered. Many passengers were upset because they paid and expected to fly with EL AL but actually were transported with a foreign airline and crew. Most pilots were upset by the situation. Finally, on 4 December 2016 an ‘efficiency agreement’ was signed as an addendum to the collective agreement between EL AL and the Histadrut labor federation regarding the pilots sector. The agreement called for commitments to labor peace and maintaining EL AL’s flight schedules and training program; the pilots gained additional compensation, better working conditions and other benefits; while the airline obtained more efficiency, flexibility and cost-savings in operations. These and additional provisions, including a quota limitation on the number and types of aircraft that could be wet-leased by EL AL in the future, were embodied in a longer-term agreement signed on 29 October 2018 among EL AL, the workers’ union and the Histadrut that settled the agreements between the pilots and EL AL for a seven-year period ending 31 October 2024.

The issue of the pilots over age 65 discussed above, however, was not resolved in the December 2016 agreement. During January and early February 2017, some pilots again disrupted training procedures and flights. This dispute was resolved on 17 February 2017 by a ‘Veteran Pilots Agreement’ that addressed the position of senior pilots reaching 65. It provided that some of the pilots over 65 would serve as instructors and supervisors, while others would retire and be entitled to certain retirement grants. This agreement became effective for seven years, through 2024.

Financial Developments.

The swings in profitability of EL AL that characterized the first half of the 2010s continued during the second half. Years 2015 through 2017 were each profitable with net income of $106.5, 80.7 and 5.7 million respectively, and dividends were paid each year to the airline’s shareholders. 2018 and 2019, however, experienced net losses of $53.2 and 59.6 million respectively. A portion of these variations in profitability result from external factors beyond EL AL’s control. These factors include changes in jet fuel expenses, currency exchange rates and interest rates. For example, jet fuel amounts to between 23% and 30% of all operating expenses, and in 2018 EL AL’s jet fuel expenses increased by 96.6 million compared to 2017, enough in itself to make the difference between a profitable year or not.

The financial results of 2018 and 2019 were also impacted by, among other things, the costs of introducing the 787 fleet while simultaneously retiring the 747-400 and 767-300 fleets. Air crews for the new 787s had to be trained and assigned. Meanwhile, EL AL could only partially benefit from the operational efficiency of the new aircraft (in terms of fuel and maintenance costs) due to their gradual entry into service over the course of three years, the temporary lack of product uniformity among the wide-body fleet during the transition period, and the customers’ partial exposure to the improved product.

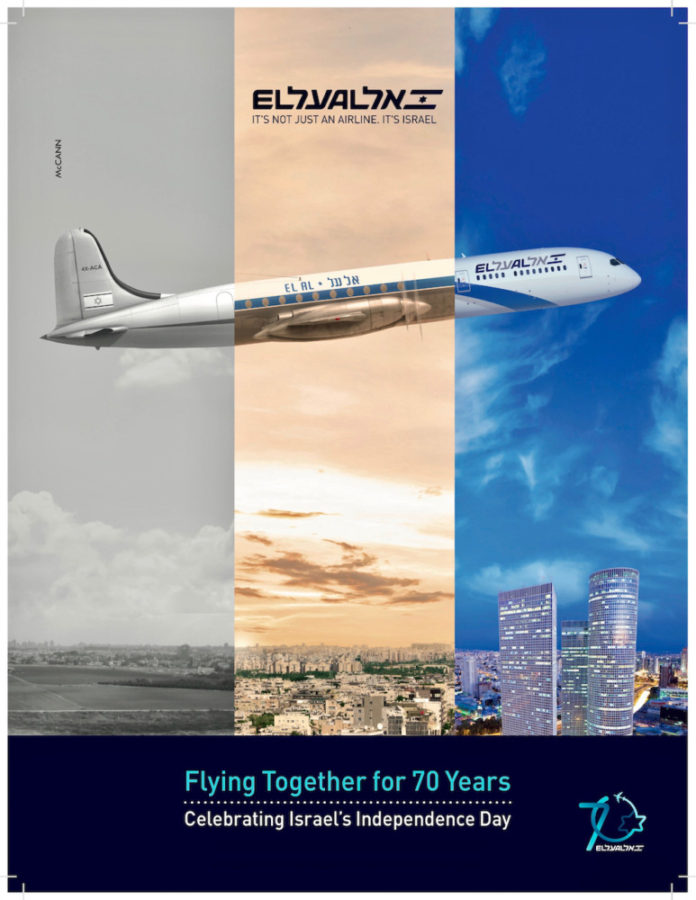

EL AL 70th Anniversary — 2018/2019.

2018/2019 marked EL AL’s 70th anniversary, as it had been established in November 1948 and operated its first regularly scheduled flight on 31 July 1949. Many publicity souvenirs marked the anniversary — here are a few examples.

Simultaneously, EL AL celebrated the delivery of 13 new 787 Dreamliners between February 2018 and December 2019, marking a quantum advance in the quality, efficiency and comfort of its wide-body, long-range fleet and allowing it to start flights to more destinations. With a young, modern fleet and renewed enthusiasm, EL AL was looking forward to reaping the rewards of its advanced new aircraft in 2020 and beyond.

A Report out of Wuhan

On 31 December 2019 a first international public report was received from the government of Wuhan, China stating that Chinese health authorities were treating dozens of cases of ‘pneumonia’ of an unknown cause. Days later, researchers in China identified a new virus that had caused those infections and was rapidly spreading. The virus became known as ‘Covid-19’.

As the year 2020 dawned, little did EL AL, the aviation industry, or the entire world know that this virus would become a pandemic and that global life in general, and commercial aviation specifically, would be transformed in 2020 and beyond.

The next chapter of ‘EL AL: Israel’s Flying Star’, Chapter 13, covers the transformation of EL AL that started in 2020 and is continuing.

Last updated 2 August 2023.

Copyright 2021-2023, Marvin G. Goldman